Search by topic:

The latest thoughts from leading Corporate Venture Capital (CVC) funds investing in innovation to decarbonize their respective industries.

Whereas traditional venture capital funds are purely financially oriented, CVCs’ objectives often bifurcate into prioritizing strategic and financial returns. In a world of corporate net zero commitments, CVCs have bolstered their mandates to invest in accelerating climate technologies.

Startups are considered to be bad at scaling, and corporates bad at innovating - so the upsurgence in CVCs’ investment into climate startups is exciting for their partnership potential to scale climate innovation.

I'd love to see some Aussie success stories here.

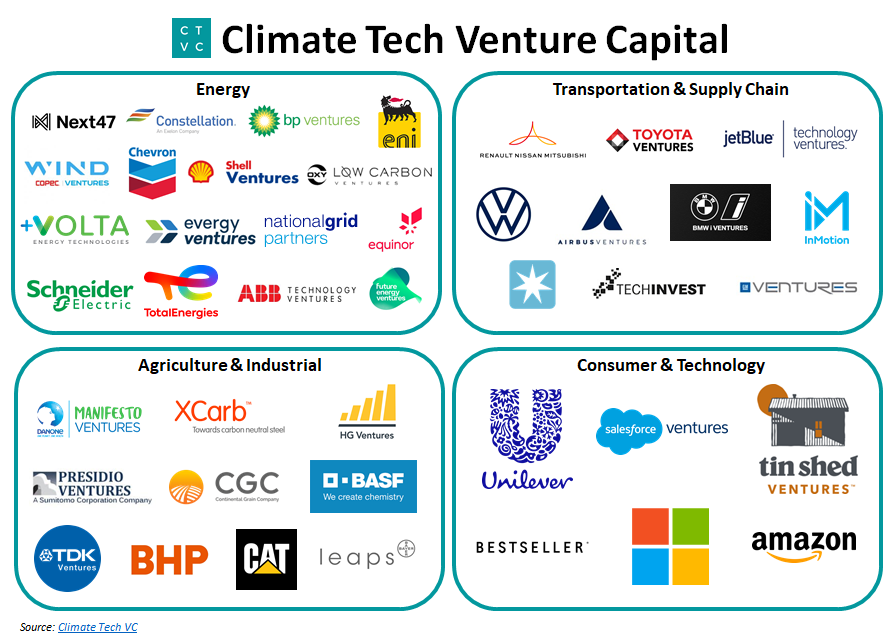

image credit: ClimatechVC

https://climatetechvc.substack.com/p/-corporate-climate-venturing